Truth + Decency in personal finance.

No advertisers.

No affiliates.

No financial products.

Imagine that.

An independent, trustworthy resource in an industry awash with sales pitches and interest conflicts.

Who we are.

Dorks in Kansas.

We’re a small team of finance and technology experts dedicated to improving the information and resources available to investors and advisors.

Why you can trust us.

Our views aren’t for sale.

Honest Math is truly independent. We are not owned by any robo-advisors, banks, retail investment platforms, or broker-dealers. We sell no financial products, and we receive no compensation from sponsors, advertisers, or affiliates.

Our founder is a partner in a municipal advisory firm with extensive experience providing quantitative analysis exclusively to government entities.

As a result, we’re positioned to offer analytics and perspectives without industry conflicts or hidden motives.

Why we do this.

Somebody must.

HonestMath.com is a passion project. Our founder is a finance professional with little patience for bad analysis, and frustration with the devastating impact that low-quality ideas continue to have on unwitting retail investors.

How is our software free?

It probably shouldn’t be.

It’s not easy—we put a lot of time and money into the software, analytics, and research on our website. Keeping it free encourages site traffic as we continue to build a brand.

Premium features are on the way.

Premium Features

For advisors and serious DIY investors

Coming Soon

More tools

Advanced simulation features

Premium research and analysis

100% Free

$0. There’s no catch.

Step 1: Create an account

Step 2: Run unlimited simulations

Step 3: Provide feedback (or don’t)

100% Private

We don’t need to know you.

We don’t ask for sensitive information

We don’t monitor or store your assumptions

We don’t sell or share your email address

We don’t link to your financial accounts

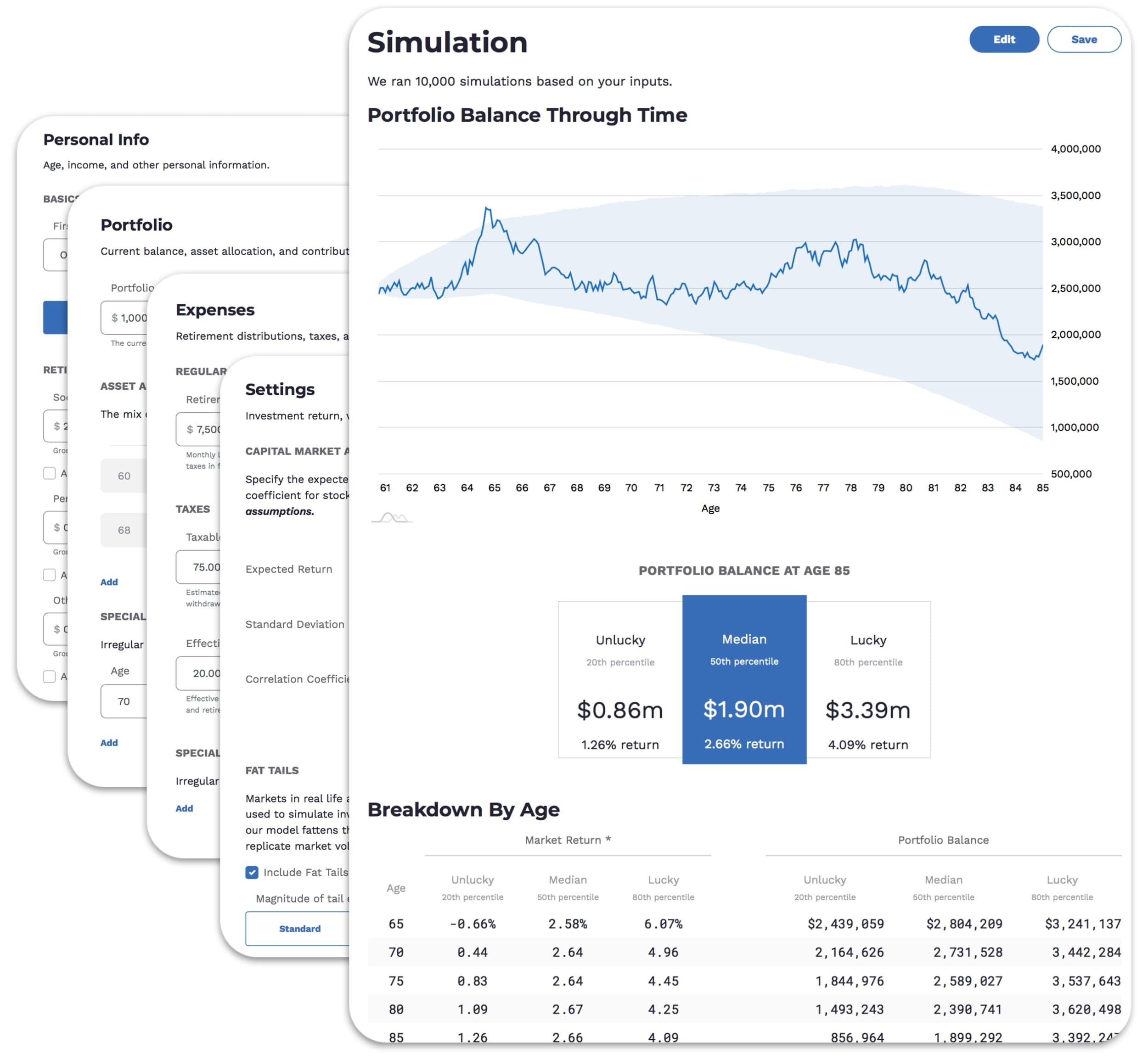

We have fat tails

Stress test your retirement portfolio against real-world volatility.

Finally, a Monte Carlo engine that replicates wild market swings.

Exposing grifters and educating the public

A force for good on Twitter.

You can watch us slaughter sacred cows and challenge industry charlatans in real time.

Public Challenge to the Founder of MPI Unlimited

To date, our challenge has not been accepted.

The status quo is unacceptable.

67%

Percentage of industry leaders in North America that agree clients are often sold inappropriate financial products.

Inappropriate products result in hidden or unnecessary costs.

You’re especially vulnerable to certain costs if your “advisor” works for a bank or brokerage firm. The various fees and expenses add up fast, often reaching 2.0% per year or more.

Excessive fees devastate your nest egg over time.

40%

Percentage of your portfolio lost to annual fees and expenses of 2.0% over a 40-year period.

$1 saved annually and invested at 7.0% = $214

$1 saved annually and invested at 5.0% = $127

But smart investors are catching on.

Bogleheads, YouTube, Reddit—access to expertise is freely available to those that know how to parse it. Smart, industrious investors are fleeing broker-dealers and active management in favor of independent advisors and index funds.

In an industry focused on selling products instead of providing advice, who can you trust?

You.

Our vision of the future requires giving people direct access to professional-grade financial planning software. If you’re less reliant on pros for sophisticated tools, then you’re also less vulnerable to industry salesmanship that often does more harm than good.